- 11.04.2023

- 353

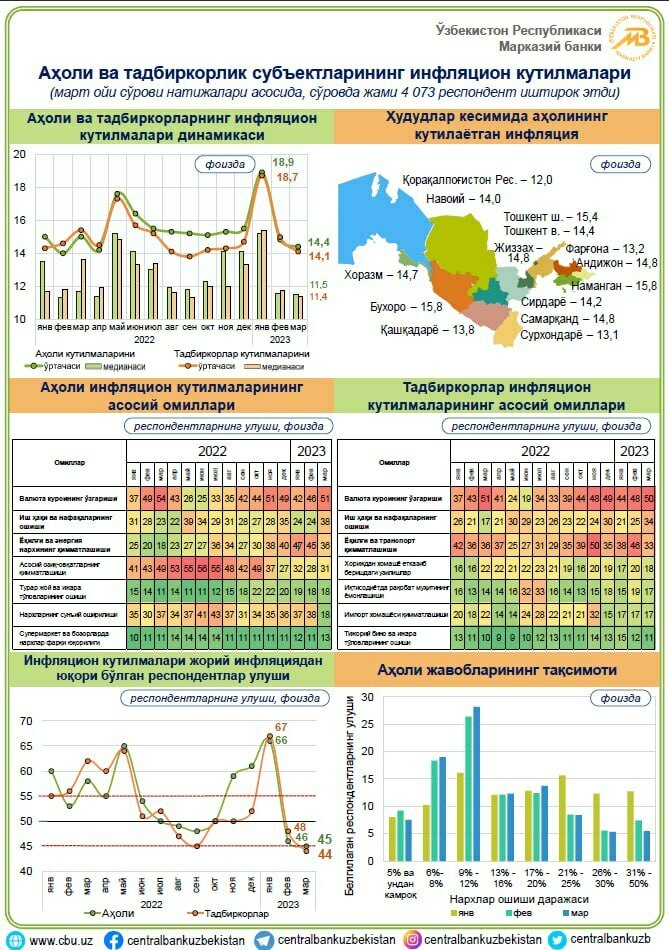

After a three-month hiatus, Central Bank resumed releasing data on inflation expectations for households and businesses. In January, household expectations reached 18.9%, and businesses 18.7%, marking the highest levels since July 2020. By March, expectations significantly decreased to 14.1−14.4%.

The Central Bank of Uzbekistan has recommenced the release of information regarding inflation expectations for households and businesses over the forthcoming 12 months.

Previously, the regulator provided an overview in November in the form of an infographic, lacking the detailed commentary traditionally included. Since that time, no further updates on this subject have been published.

In January, population inflation expectations amounted to 18.9%, while businesses' expectations reached 18.7%. Concurrently, the Statistics Agency under the President reported an annual inflation rate of 12.2% for the same month, resulting in a 6.5−6.7% disparity between expectations and official inflation.

During that period, Uzbekistan experienced an energy crisis characterized by interruptions to electricity and gas provisions, the temporary halt of operations at various enterprises, and a downturn in industrial output, including a reduction in food production.

The recorded inflation expectations in January were the highest since July 2020, when household expectations reached 19.7% and business expectations stood at 20.1% during the peak of the pandemic and a period of heightened uncertainty. At that point, the difference between expectations and official inflation (14.4%) ranged between 5.3% and 5.7%.

Nonetheless, by February 2023, the expectations of both the population and businesses dramatically dropped to 15%, and further declined in March to 14.4% and 14.1%, respectively.

In January, the number of respondents anticipating inflation rates of 9−12% and 21−25% were almost equal; however, by March, the disparity between the two categories had grown to 3.5 times. In January, the population’s inflation expectations were primarily influenced by the increasing prices of fuel and energy resources, with 47% of respondents citing this factor (compared to 36% in March), changes in the exchange rate at 42% (51% in March), artificial price hikes at 37% (18% in March), and rising costs of basic food items at 32% (31% in March).

In contrast, businesses identified currency fluctuations as the primary driver of inflation, with 44% of respondents in agreement (50% in March), followed by fuel and energy prices at 38% (33% in March), and escalating wages at 21% (34% in March).

In the field of economics, it is widely acknowledged that the public’s anticipation of future inflation can impact its course, which is why central banks closely monitor inflation expectations when determining monetary policy. When businesses and households foresee heightened inflation, the former may be inclined to increase prices while the latter may seek higher wages, thus influencing the inflationary trend.

Increasing prices and wages can subsequently propel inflation, prompting businesses to incorporate anticipated inflation acceleration into pricing, while the populace may seek a corresponding wage indexation. However, if individuals perceive the inflation surge as transitory, long-term expectations may not elevate — this anchoring of inflation expectations hinges on faith in central bank policy. When businesses and the public trust that monetary policy will realign inflation with targeted levels, concerns about future price increases are diminished.

Source: https://www.gazeta.uz/en/2023/04/11/inflation-expectations/

Information service of JSC «NEG of Uzbekistan»